This is the English edition. → 日本語版はこちら

AURAS is still relatively unknown in some regions,

but it’s actually a widely used online travel insurance service among international travelers.

When I personally signed up for it, I realized how different it was from the traditional insurance I had known.

There were quite a few unclear points in the explanations, so I carefully went through the process—sending multiple emails to confirm each step.

Note: I haven’t personally filed a claim yet.

The claim-related details in this article are based on verified user reviews and official AURAS support responses.

To be honest, this was the first time I’ve ever read an insurance policy so seriously before making a decision.

Some aspects felt familiar, but others were completely new.

In this article, I’ll walk you through those differences, highlight key points to watch out for, and share what I wish I had known in advance.

If you’re unsure whether to sign up,

or you’re looking for a travel insurance plan that allows mid-trip enrollment,

I hope this guide helps you make an informed choice.

🌍 View AURAS Insurance (10% Discount Code Included)

👉AURAS Travel Insurance – Official English Page

(10% discount code: WRTY100286)

More Articles in the AURAS Series (6 Articles)

👉My AURAS Experience (JP)

👉Complete Guide: Features & Tips (EN)

👉Coverage Patterns: 90+ Days & Sports (JP)

👉Monthly Plan Explained (JP)

👉NEW Inside AURAS: The Real Truth (EN)

👉NEW Insurance Claims: Process, Docs & Warnings(JP)

*EN = English article / JP = Japanese article

- Introduction: What Makes AURAS Unique, and Who Is It For?

- Can You Trust AURAS? Company Overview & Real Reviews

- How to Sign Up for AURAS (With Screenshots & Tips)

- After Purchase – How to Access Your Policy & Get Support

- How to Cancel and Get a Refund – Is the 14-Day Guarantee Real?

- Using AURAS to Extend Your Credit Card Travel Insurance

- 📘 7 Key Things to Know About AURAS Travel Insurance

- ✈️ Summary – Is AURAS Right for You?

Introduction: What Makes AURAS Unique, and Who Is It For?

If you’ve ever relied on a credit card’s built-in travel insurance, you probably know that coverage often ends after just 90 days.

For long-term travelers, digital nomads, or those on extended cruises, this creates a frustrating gap in protection—right when you might need it most.

Finding a travel insurance plan that allows mid-trip enrollment is surprisingly difficult.

That’s why I was intrigued by AURAS—

a flexible, online-based provider that lets you sign up even while traveling, works for cruises, and even offers a discount code.

I thought, “Wait, a policy this flexible exists? I’ve got to try this!”

So I did.

AURAS offers a 14-day cancellation window with a refund option, and the price was impressively affordable.

That sealed the deal—I decided to go for it and test everything:

I signed up, canceled, and re-applied. Everything you’ll read here is based on my real experience.

💡 AURAS is a great fit for:

- Travelers whose credit card insurance has expired

- Those who want to top up their existing insurance with extra coverage

- People who need an insurance certificate for visa applications

- Budget travelers looking for simple and affordable options

- Anyone whose coverage ran out mid-trip

- Seniors who thought they were too old for insurance (AURAS covers up to 100 years old!)

Want to see key points for each sign-up pattern? 👇

👉 Top 5 AURAS Enrollment Patterns – Mid-Trip, Long-Term (90+ Days), and Sports Plans (JP)

AURAS Supports Visa Applications

AURAS can issue an official insurance certificate in English,

which can be used for visa applications at embassies or immigration offices.

It’s suitable for digital nomad visas, student visas, or long-term stay permits

that require proof of travel or health insurance.

Please note that the requirements vary by country,

so be sure to check with the relevant embassy or consulate before applying.

👉 Read our guide on insurance certificates required for visa applications

📄 About the Insurance Policy Document

AURAS provides a full Policy Document outlining coverage and rules.

You’ll find the link on the first step of the application, and receive it again via email as a PDF after signing up.

Since the policy may be updated over time, I’ve chosen not to repost the full document here.

👉 Insurance Policy (Official Link)

If you’re curious, try entering your travel details on the official AURAS website to get a quick quote.

You might be surprised — it’s often much more affordable than expected!

Can You Trust AURAS? Company Overview & Real Reviews

🔗 Want a deeper look into how AURAS works and why reviews are divided?

👉 Read the full breakdown: AURAS Travel Insurance Reviews & Pricing Explained (2025 Edition)

Japanese reviews are still limited, so AURAS can feel unfamiliar. Globally, however, it is increasingly used by digital nomads and long-term travelers. If you’re comparing options, focus on coverage fit and claim rules rather than brand familiarity.

Company & Licensing Information

AURAS is operated by Aura Global FZ-LLC, a company registered in the Ras Al Khaimah Economic Zone (RAKEZ) of the United Arab Emirates (UAE).

It functions as an international insurance platform, while the actual underwriting is handled by its licensed partner, IC “EIG” LLC based in Anjouan, Union of the Comoros.

In other words, AURAS manages sales, customer service, and claims support,

while the policies themselves are issued under the IC EIG insurance program.

💡 Although AURAS is a relatively new global brand, it stands out for its flexible features—such as post-departure enrollment and monthly subscription plans.

For long-term travelers, it’s generally advisable to start with a short-term or monthly plan rather than a long multi-year contract.

Outside the Scope of Japanese Insurance Law

AURAS is an international insurance platform registered outside Japan and therefore not supervised by Japan’s Financial Services Agency or other domestic authorities.

All contracts, claims, and communications are handled in English,

so users are advised to apply and manage their policies at their own discretion and responsibility.

What Do Travelers Say? User Reviews from Abroad

On the global review site Trustpilot, AURAS currently holds a rating of 3.7 out of 5.0 (as of October 2025).

💬 Positive feedback:

- Smooth reimbursement after medical visits (treatment → refund)

- Instant issuance of policy certificates

- Polite and responsive English-language support

- Refund processing can occasionally take longer than expected

- Incorrect activity-type selection has caused coverage issues

- Policy wording can be difficult to read (English only)

If you plan to use AURAS, be sure to read the policy carefully—especially the “24-hour reporting rule” and the list of covered activities.

Although a few reviews are critical, I personally contacted the AURAS head office to verify the facts.

👉 The Real Truth: How AURAS Works Behind the Scenes (EN)

Below is the official statement we received from AURAS.

AURAS is a flexible option for digital nomads and long-term travelers, but those seeking maximum claim-handling security may also wish to compare other providers such as SafetyWing and Genki Traveler.

👉 Compare 7 Overseas Travel Insurance Plans (JP)

👉 View AURAS Enrollment Patterns & Plan Types (JP)

How to Sign Up for AURAS (With Screenshots & Tips)

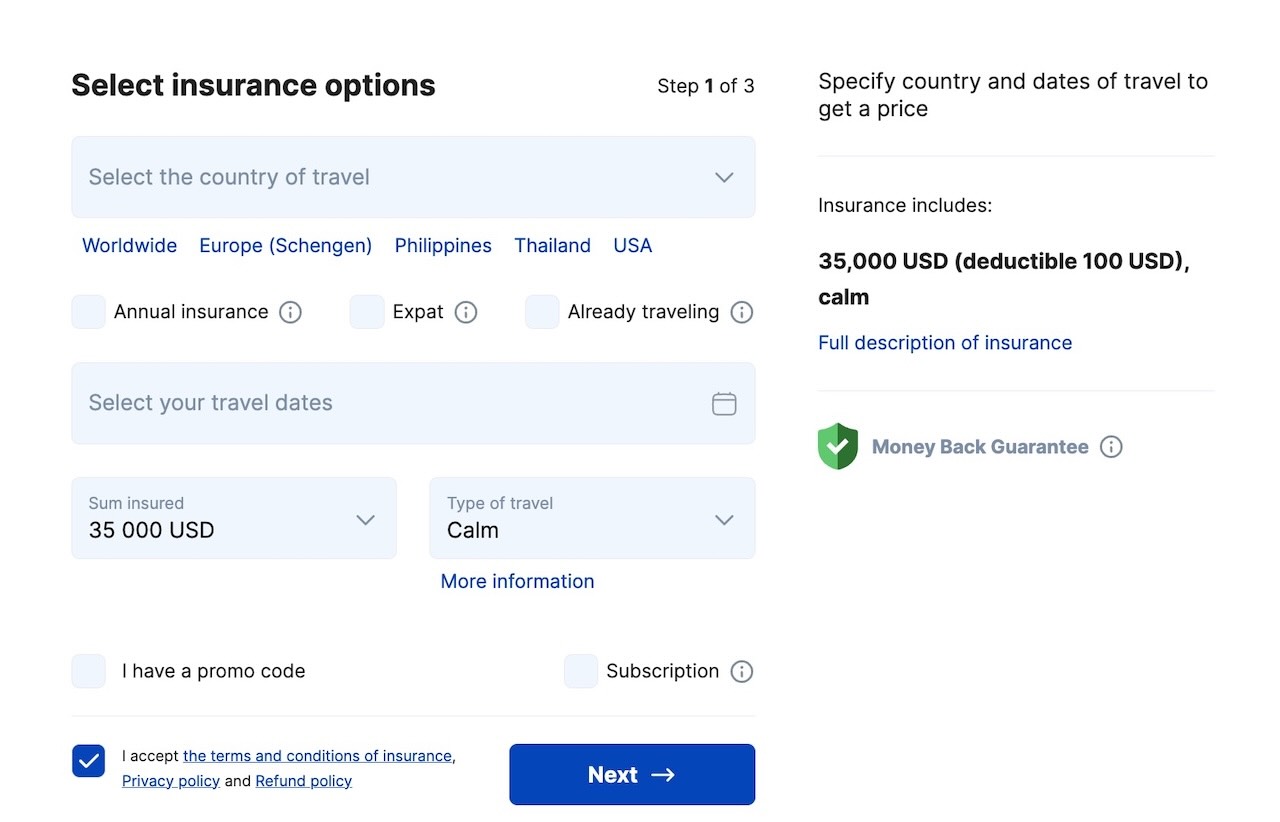

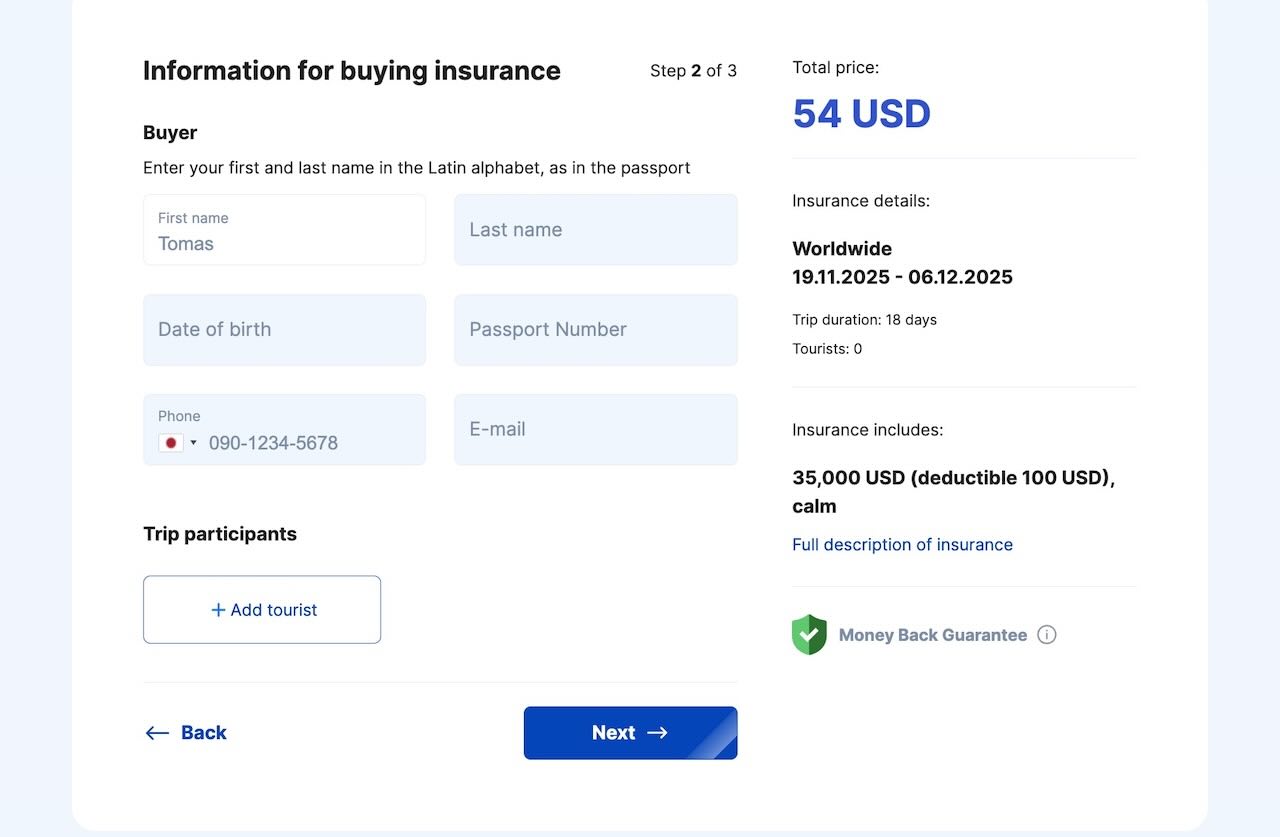

Signing up for AURAS takes just 3 simple steps, all done online.

You can apply quickly from your phone, tablet, or laptop.

That said, since the interface is entirely in English and includes some unusual dropdown choices,

I’ve included screenshots and walkthroughs to help you avoid any confusion.

🌍 View AURAS Insurance (10% Discount Code Included)

👉AURAS Travel Insurance – Official English Page

(10% discount code: WRTY100286)

🧭 Step-by-Step Overview: 3 Main Screens

AURAS’s application flow consists of three clean, simple pages:

In the next section, we’ll walk through each screen in detail.

If you’re wondering things like “What does ‘Worldwide’ mean?” or “How do I choose the right travel type?”, we’ve got you covered!

Step ① — Entering Policy Details (Avoid Costly Mistakes!)

The first screen of the AURAS application asks about the core elements of your trip—where you’re going, how long you’ll be abroad, and what kind of travel you’ll be doing.

⚠️ These inputs determine whether you’re covered or not, so choose carefully!

✅ Destination (Coverage Area)

Are there any excluded countries?

✅ Coverage Amount (USD / EUR)

✅ Travel Type (Plan Category)

💬 Note:

Some of the following details are based on answers received directly from AURAS official chat support (as of June 2025).

In a few cases, actual practices may differ slightly from what’s written in the Policy Document.

⚠️ This is the most important choice in the whole application.

If you select the wrong type of travel, your claims may be denied.

🛳 Cruise

- Best for: Travelers on ocean or world cruises

- Details: Ideal for long voyages such as Princess Cruises or world cruises.

- Note: Common cruise activities like dancing or sports may require the Active plan (per AURAS official classification).

🌿 Calm

- Best for: Light activities like yoga, city walks, and sightseeing

- Details: Lowest cost option with limited coverage range.

🏄♀️ Active

- Best for: Moderate activities such as surfing, trekking, or dancing

- Details: Broader coverage than Calm; slightly higher premium.

⛷ Extreme

- Best for: High-risk sports like skiing, mountaineering, or bungee jumping

- Details: More expensive than Active; intended for riskier sports.

⚽ Sport

- Best for: Participants in sports training or competitions (amateur or professional)

- Details: Designed for competitive or organized sporting events.

🎓 Study / Work

- Best for: Students or expatriates living abroad

- Details: Coverage applies only within the country of residence; documentation (school or employment certificate) required.

📌 Note from AURAS Support (Updated October 2025)

❗️Common Misunderstandings:

Some activities look Calm but are actually Active!

📌 Update: August 2025 (Current Specification)

🏔️ Machu Picchu Activity Classification (Updated October 2025)

✅ Key Checkboxes You Shouldn’t Miss

Before submitting your application, make sure to review these important checkboxes:

- Already Traveling

Required if you are applying from abroad.

If this is unchecked, your policy may be considered invalid. - Expat / Annual Insurance

Choose this only if it matches your long-term residence or work situation.

Details are available in the Policy Document. - Subscription (Monthly Payment Plan)

Check this if you want the 30-day monthly payment plan.

If you leave it unchecked, you will be enrolled in a regular fixed-term policy instead.

A PDF insurance certificate is issued immediately, suitable for visa applications. - Using AURAS as a Top-Up to Your Credit Card Insurance

Simply enter the coverage dates you need—the system will calculate everything automatically.

⚠️ If you rush through this part, you might later hear:

> “Unfortunately, you didn’t select the correct options, so your claim is not covered.”

Some options may seem unclear or easy to overlook,

so I highly recommend reviewing the AURAS Public Offer

(Policy Document) or chatting with AURAS support if you’re unsure about anything.

Want to see key points for each sign-up pattern? 👇

👉 Top 5 AURAS Enrollment Patterns – Mid-Trip, Long-Term (90+ Days), and Sports Plans (JP)

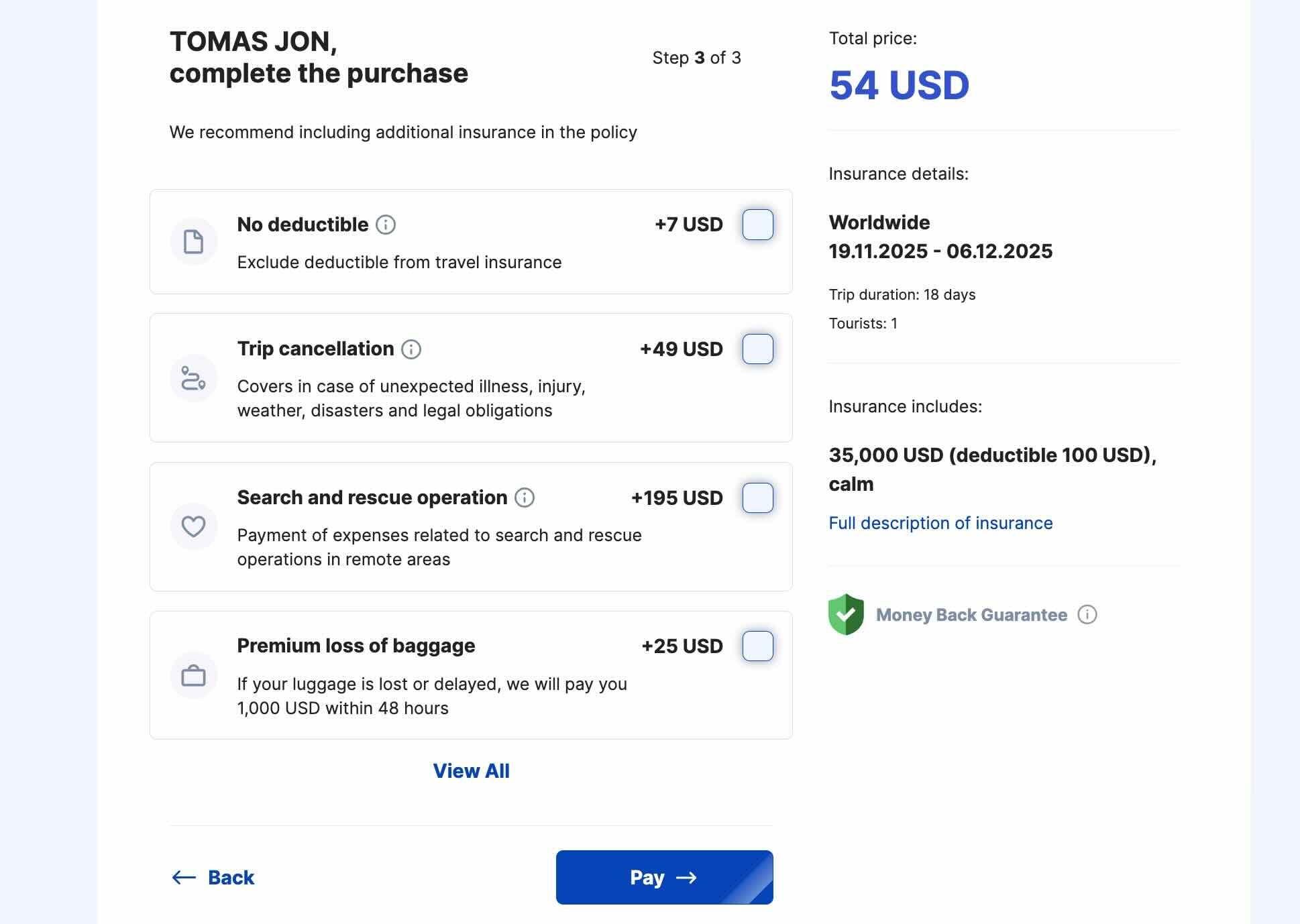

Step ③ — Optional Coverage & What to Know Before You Choose

The third screen lets you choose optional add-ons based on your travel needs.

Optional Add-Ons (Additional Coverage)

👉 Check out this guide on how travel insurance connects to visa applications (JP)

✅ What Is Search and Rescue in AURAS?

🚁 Helicopter Evacuation Is Included by Default

Emergency airlift is included in the base medical coverage

(limit depends on plan; at higher tiers it can be up to $10,000).

You don’t need to pay extra specifically for helicopter transport.

🧠 Final Tips

- If unsure, it’s safer to add options now — You can’t make changes after payment.

- Choose based on your travel style — Cruises, skiing, working holidays… every situation is different.

- Check the Policy Document or chat with AURAS support — When in doubt, always verify before applying!

Here are the options available (as of June 2025):

👉 See the AURAS Public Offer(Policy Document)

After Purchase – How to Access Your Policy & Get Support

Once your payment is complete, your insurance policy (PDF) will be sent to your registered email right away.

It includes your Policy Number, and all your details can be accessed on your smartphone.

📱 How to View Your Policy on Your Smartphone (Using the QR Code)

How to Cancel and Get a Refund – Is the 14-Day Guarantee Real?

AURAS allows you to cancel your policy within 14 days of purchase,

as long as coverage has not started yet.

This works like a cooling-off period, and is explicitly stated in their policy documents.

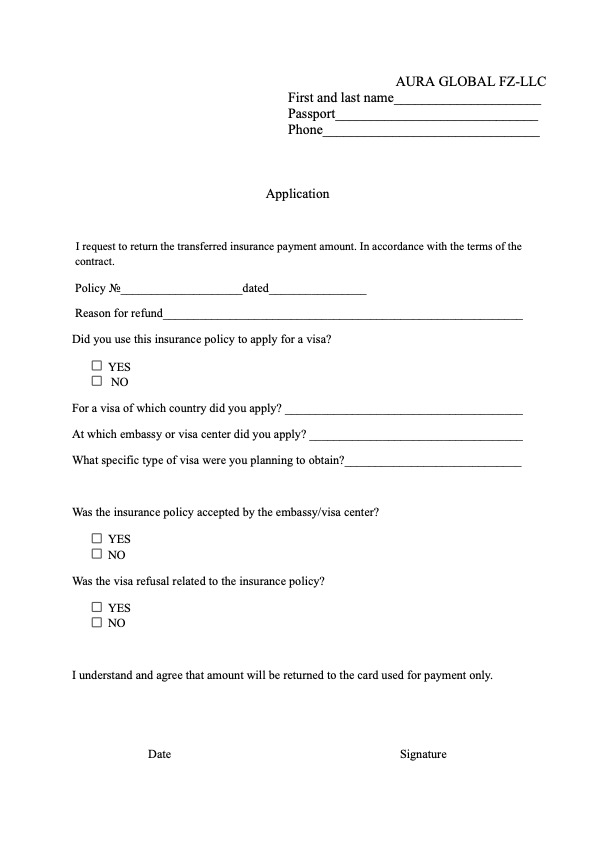

📝 How to Request a Cancellation Form

🗓️ My Actual Refund Experience (June 2025)

👉 The monthly subscription plan (no partial refunds, auto-renewal explained step-by-step) is covered in our Monthly Plan Guide — Read here (JP)

Using AURAS to Extend Your Credit Card Travel Insurance

Some credit cards, especially in Japan, come with built-in travel insurance that typically covers up to 90 days from departure.

For long-term travel or cruises, this leaves a gap in coverage after the 90-day limit.

AURAS allows you to fill this gap by starting coverage from the day your credit card insurance ends until your return date.

- If purchasing before departure → No need to check “Already Traveling”

- If purchasing during the trip → You must check “Already Traveling” (coverage starts 48 hours after payment)

📘 7 Key Things to Know About AURAS Travel Insurance

Based on the official Policy Document (as of June 2025)

💬 Note:

Some details below are based on official answers received from AURAS chat support (June 2025).

Actual operational practices may differ slightly from what is written in the Policy Document.

When choosing travel insurance, the biggest question is always:

“Will it actually work when something goes wrong?”

After reviewing the full AURAS Policy Document,

here are 7 essential points every traveler should know:

① When Does Coverage Start? (p.19)

② Cancellation / Cooling-Off Policy (p.13)

③ How to File a Claim (p25 & p29)

④ Report the Incident Within 24 Hours (p.25)

⑤ Language of Medical Documents (p.22)

⑥ What Does AURAS Cover? (p.6–11)

⑦ Why AURAS Is Affordable: The USD 100 Deductible Structure (P3, P12)

AURAS works differently from traditional travel insurance —

more flexible, more customizable, and suitable for longer, independent travel.

It’s not for everyone,

but for digital nomads, long-term travelers, and frequent cruisers,

the flexibility is a major advantage.

✈️ Summary – Is AURAS Right for You?

After using AURAS myself, here’s what stood out the most:

- Flexible plans where you choose only the coverage you need

- Easy online signup with credit card payment

- A 14-day refund window before coverage starts (subject to policy conditions)

That said, if you prefer step-by-step guidance in your native language or need support in more structured formats, AURAS might feel a bit too hands-off.

In Summary:

- Comfortable managing things on your own? → AURAS is a solid option.

- Prefer full support or feel unsure about handling documents in English? → A more guided insurance provider may suit you better.

- Fill the coverage gap after your credit card insurance ends

- Join a plan even after your trip has already started

- Keep costs low while customizing your plan

🌍 View AURAS Insurance (10% Discount Code Included)

👉AURAS Travel Insurance – Official English Page

(10% discount code: WRTY100286)

I’m currently using AURAS myself, and so far everything has been smooth — but real stories from other travelers are incredibly valuable for those who are considering the service.

If you feel comfortable, please share your overall impressions in the comments:

• how the process went

• how the support felt

• anything you noticed while using the policy

Your input can help future travelers make a more informed decision.

*Please avoid sharing personal details such as payment amounts or sensitive information. General impressions only are appreciated.*

More Articles in the AURAS Series (6 Articles)

👉My AURAS Experience (JP)

👉Complete Guide: Features & Tips (EN)

👉Coverage Patterns: 90+ Days & Sports (JP)

👉Monthly Plan Explained (JP)

👉NEW Inside AURAS: The Real Truth (EN)

👉NEW Insurance Claims: Process, Docs & Warnings(JP)

*EN = English article / JP = Japanese article

🇯🇵 日本語で読みたい方はこちら →

AURAS 海外旅行保険(日本語版)